And when employees drive their company car on private journeys they will use the aer to repay the cost of electricity at 4p per mile.

Hmrc business mileage rates for electric cars.

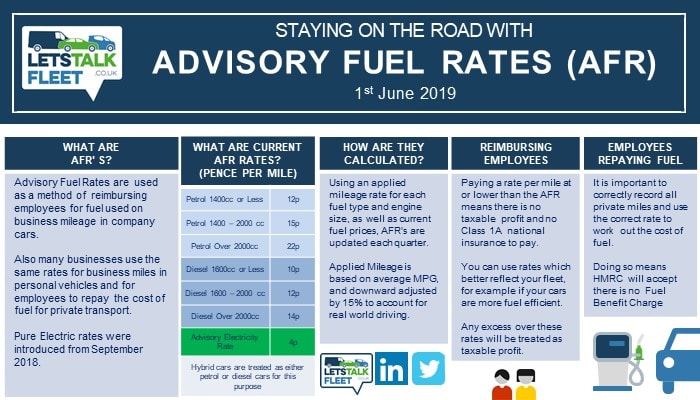

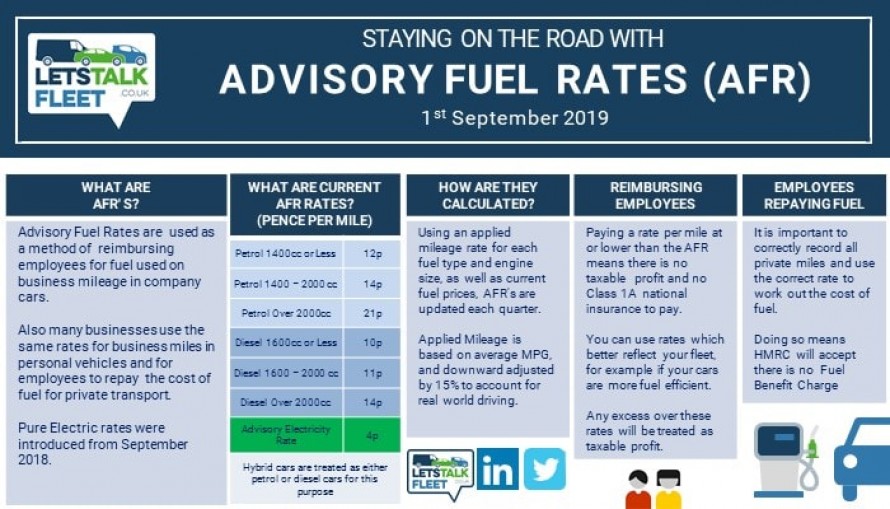

The advisory electricity rate for fully electric cars is 4 pence per mile.

First 10 000 business miles in the tax year each business mile over 10 000 in the tax year.

Hmrc calls this rate the advisory electricity rate aer.

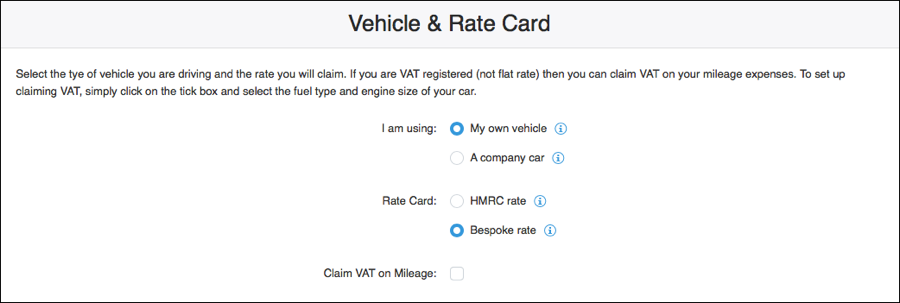

If you re working out business mileage based on a personal electric vehicle or if you re claiming for your home office the full amap allowance can be claimed.

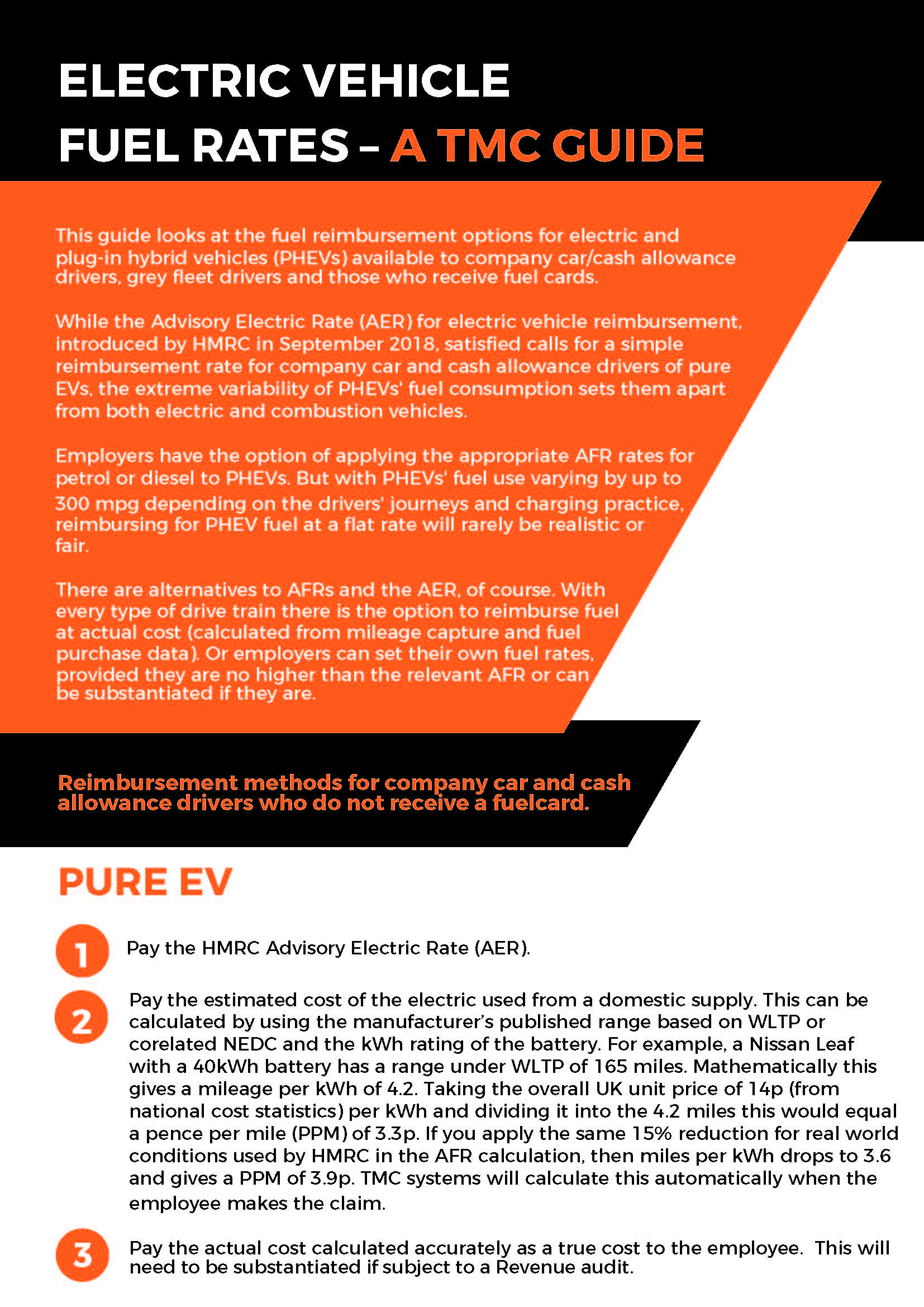

The sale of electric and hybrid cars have seen a massive boom over the last couple of years.

As a milestone decision this is the first opportunity for company cars to be taxed at 0 as a benefit in kind bik helping businesses make the transition to zero emission vehicles and a potentially emission free future.

Some people buy these cars as an eco friendly alternative to the large petrol engines and soon to be phased out diesel engines.

The advisory fuel rates for petrol lpg.

In the united kingdom it s been suggested by hmrc her majesty s revenue customs that as of september 2018 the official mileage rate for electric cars is 4 pence per mile which is the advisory electricity rate aer this policy may sound fair since it s an exact calculation of average cents per mile reimbursement.

The main and special rates apply from 1 april for limited companies and 6 april for.

Their increasing popularity saw hmrc introduce mileage reimbursement rates for hybrid and electric vehicles in 2018.

Use hmrc s maps working sheet if you need help.

With effect from 1 september 2018 the official mileage rate for electric company cars is 4 pence per mile.

To calculate the approved amount multiply your employee s business travel miles for the year by the rate per mile for their vehicle.

For example if an employee travels 8 000 business miles in their fully electric company car they can receive 320 in mileage for the tax year free of tax or nic.

From 1st september 2018 employees driving on business in a pure electric company car can claim 4p per mile.

This is 45pp for the first 10 000 miles and 25pp thereafter.

The rate you can claim depends on the co2 emissions of your car and the date you bought it.